Insure your USA vacation to cover your health insurance deductible or get a refund if you change your mind about going.

With coronavirus rates on the rise as summer starts, more travelers are investing in trip insurance for their upcoming domestic vacation plans.

Your insurance needs are different for trips within the United States than overseas journeys. Here are three tips to keep in mind when buying domestic coverage.

- Don’t pay for medical coverage you don’t need.

One of the main reasons I buy travel insurance for my overseas trips is medical coverage; my health insurance policy doesn’t extend outside of the United States.

In contrast, most U.S. health insurers cover emergency medical expenses for travelers remaining in the U.S. The catch is, they also usually require any deductible to be paid upfront. If that’s your situation, you should consider buying a travel insurance policy with minimal medical benefits that will cover your deductible.

For example, if your health insurance policy has a deductible of $5,000 that you haven’t yet met, buy a policy that offers medical coverage up to $5,000. If worse comes to worse and you need medical care, you’ll be reimbursed for your out-of-pocket deductible and then your regular health insurance policy will kick in to cover the rest of the bill.

- Pay attention to what is a covered reason for trip cancellation.

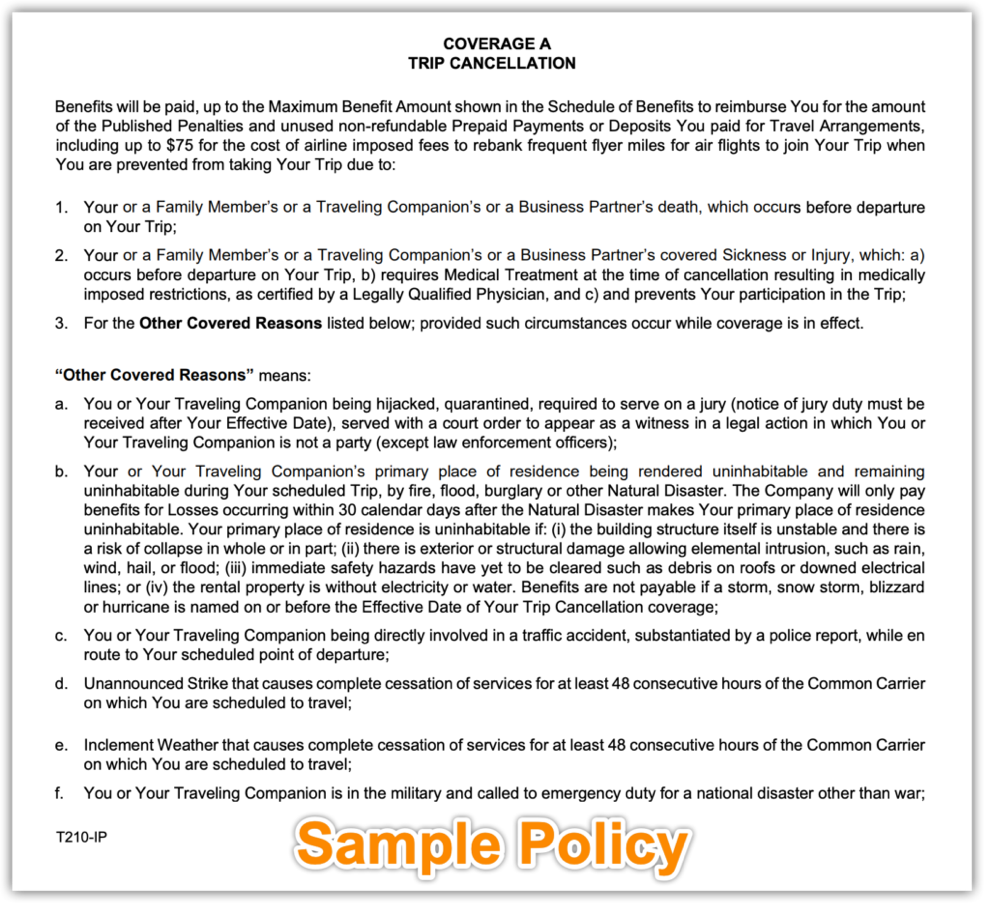

Trip cancellation coverage reimburses you for nonrefundable, prepaid expenses when a trip must be canceled or altered due to a “covered reason.” Covered reasons are the circumstances listed in the travel insurance policy that will trigger coverage if your trip is interrupted or canceled.

Every plan is different. Here’s a typical list of covered reasons:

Exclusions that render the insurance void usually include terrorist attacks, war, claims associated with psychological disorders, and risky adventure sports like paragliding.

Remember when a threat becomes “foreseen”—for example, a storm becomes a named hurricane, or a global health threat becomes a recognized pandemic—it is uninsurable unless you bought the policy before the threat was named.

Thus if you contracted Covid-19 and were prevented from traveling, and you held travel insurance before the date the viral infection became a “known threat,” your travel insurance would cover your cancellation costs. For the record, some travel insurance companies pegged mid-January as the date Covid-19 became a known threat; others deemed it as late as mid-March.

Don’t forget many credit cards provide some type of trip cancellation and interruption insurance if you use them to pay for trip expenses. Review what coverage you may already have if you carry any of the premium travel credit cards from Amex, Chase, etc.

- Consider “Cancel for Any Reason” coverage.

While some standard trip cancellation policies may cover physician-ordered quarantine or contracting Covid-19, most exclude pandemics and epidemics. They also don’t cancellations due to fear of contracting a disease while traveling or government-ordered border closures.

If you’re nervous about traveling in the time of coronavirus or to the Southeast/Caribbean during hurricane season, you may want to buy a Cancel for Any Reason (CFAR) upgrade. It costs usually forty to sixty percent more than a standard trip cancellation policy, and lets you cancel up to two to three days before your trip for just about any reason. (As always, read the policy fine print carefully for any exclusions.)

CFAR coverage generally refunds only fifty to seventy percent of your trip costs. Still, if it’s an expensive vacation and you want the freedom to cancel up to almost the last minute and get some of the cost back, CFAR may be a good choice.

Some things to remember when buying CFAR:

- You need to insure your entire trip cost; that is, the total of all your prepaid, nonrefundable trip expenses.

- Don’t procrastinate; you have to buy CFAR coverage within 14–21 days of making your initial trip payment or deposit.

- Don’t forget the cancellation deadline. Most CFAR policies require you cancel at least 2-3 days in advance.

Twist’s Take: Booking a domestic trip?

-Consider buying travel medical insurance to cover your regular health insurance deductible.

-If you’re spending a chunk of nonrefundable change, you may want to buy trip cancellation insurance, especially the “Cancel For Any Reason” kind.